Investment Funds and ETFs - Assets Brokers

Main menu

- Home

-

The Company

- About us

- Global Presence

- Strategy

- Financial Concepts

- Contact

Investment Funds and ETFs

Fund-

Fund-

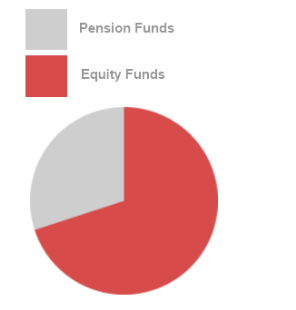

A dynamic investment strategy

Opportunity and risk: high

__________________________________

Investments are concentrated in equity funds with an upper limit of 70% max. Different styles of investment (e.g., growth and value) are varied in the equity segment, according to assessment of the market. Growth securities and collateral values can predominate vis-

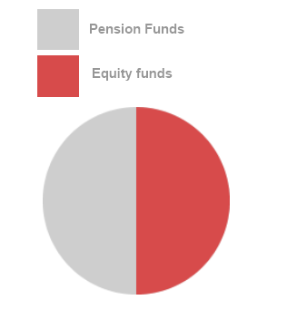

A well-

Opportunity and risk: average

A well-

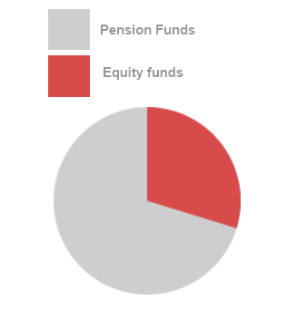

A defensive investment strategy

Opportunity and risk: low

__________________________________

Investments are concentrated in pension funds (securities bearing fixed rates of interest) with a well-