Individual Assets - Assets Brokers

Main menu

- Home

-

The Company

- About us

- Global Presence

- Strategy

- Financial Concepts

- Contact

Individual Assets

Individual Asset Management

Individual Asset Management

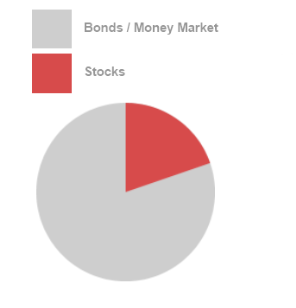

Income orientated portfolio

__________________________________

This conservative portfolio has an approx. 20:80 ratio of stocks to bonds. Our investment goal is to achieve real growth with only low levels of fluctuation in value. The investment period should be at least 3-

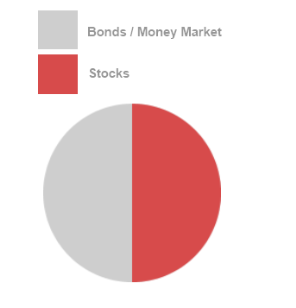

Balanced portfolio

__________________________________

This portfolio has an approx. 50:50 balance between stocks and bonds. The aim is to achieve an increased rate of return medium term. Since this portfolio may be subject to major fluctuations in value: the investment period here should be 4-

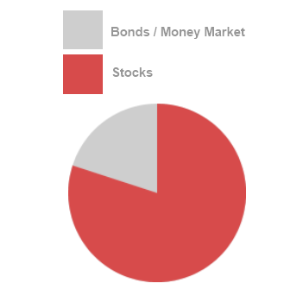

Growth portfolio

__________________________________

This growth portfolio has a stocks/bonds split of approx. 80:20 and can be subject to substantial value fluctuations. It should be possible to achieve a significant profit over an investment period of 6-

(Strong leaning towards stocks, supplemented by investments in bonds and money market instruments)